This article from the Automotivean website discusses about Motorcycle Insurance. Are you considering purchasing a motorcycle or already own one? One crucial factor to consider is the cost of motorcycle insurance. The price of motorcycle insurance can vary based on several factors, including the type of motorcycle, your driving record, and your location. Let’s delve into the details of how much motorcycle insurance typically costs and the factors that influence the premiums.

Factors Affecting Motorcycle Insurance Costs

The cost of motorcycle insurance is influenced by various factors:

- Type of Motorcycle: The make, model, and engine size of your motorcycle can impact insurance costs. Sport bikes and high-performance motorcycles generally have higher insurance premiums due to their increased risk of accidents.

- Driving Record: Your driving history and any previous accidents or traffic violations can affect your insurance rates. A clean driving record often leads to lower premiums.

- Location: The area where you live and primarily ride your motorcycle can impact insurance costs. Urban areas may have higher premiums due to increased traffic and theft rates.

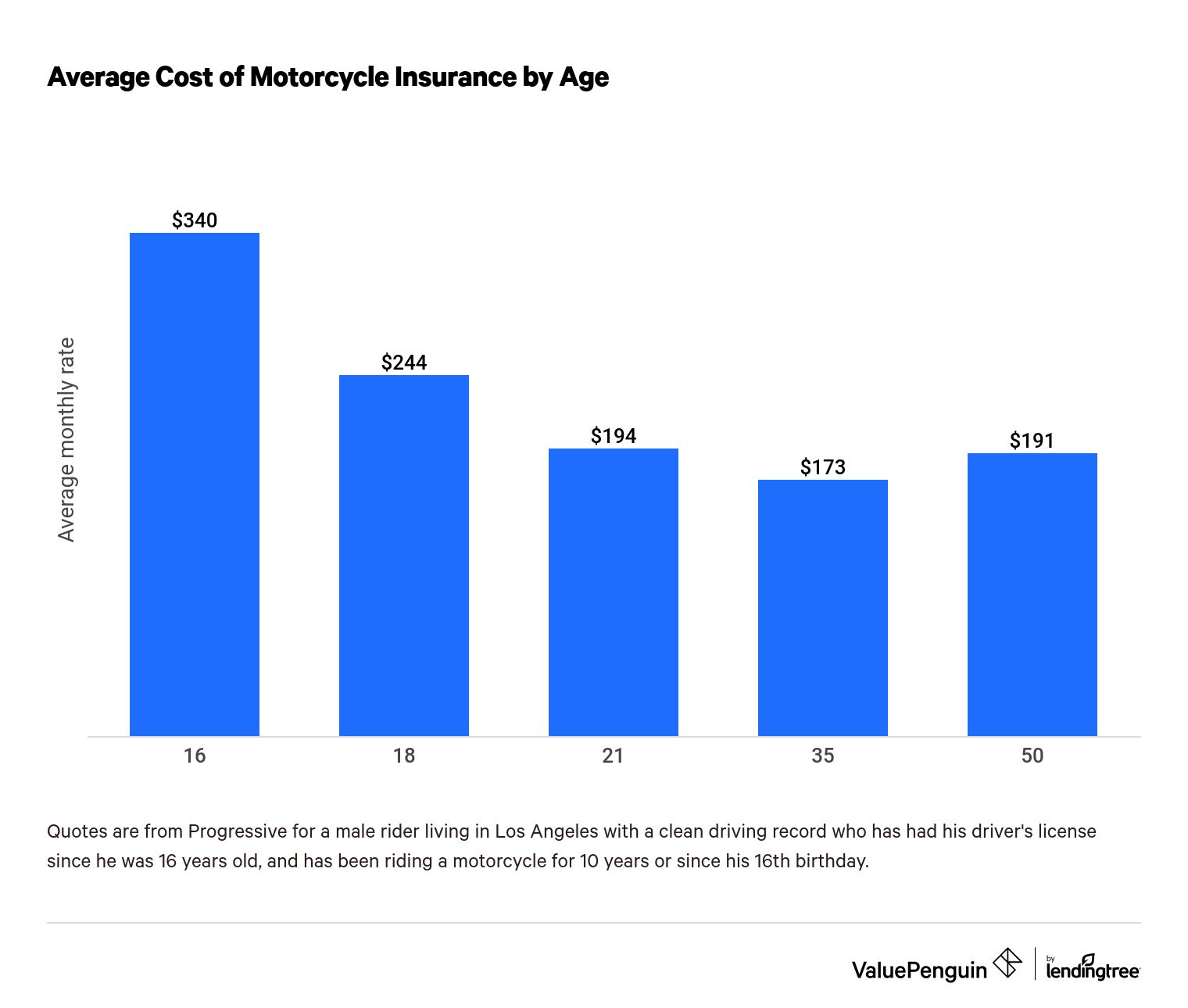

- Age and Experience: Younger and less experienced riders typically face higher insurance rates due to the perceived higher risk.

- Usage: The frequency and purpose of using your motorcycle, such as for pleasure or daily commuting, can influence insurance costs.

Cost of Motorcycle Insurance in the United States

The cost of motorcycle insurance can vary significantly across the United States. Factors such as state laws, weather conditions, and accident rates contribute to the variation in insurance premiums.

According to a recent study by MarketWatch, the average cost of motorcycles insurance in the U.S. is around $519 per year, but this figure can fluctuate based on the aforementioned factors. It’s important to obtain personalized insurance quotes to accurately gauge the cost for your specific circumstances.

Motorcycle Insurance in Texas

If you reside in Texas or are planning to ride your motorcycle there, it’s essential to understand the local insurance landscape. The state of Texas has numerous insurance providers offering a wide range of coverage options for motorcycle owners.

When researching motorcycles insurance in Texas, it’s advisable to obtain quotes from multiple insurance companies to compare rates and coverage. Factors such as the specific area within Texas, your driving history, and the type of motorcycle you own will influence the cost of insurance.

Credit: www.valuepenguin.com

How to Find Affordable Motorcycle Insurance

While the cost of motorcycle insurance can vary, there are strategies to potentially lower your premiums:

- Shop Around: Obtain quotes from multiple insurance companies to find the most competitive rates.

- Safe Riding: Completing a motorcycle safety course may make you eligible for discounts with certain insurers.

- Security Measures: Installing anti-theft devices and maintaining a secure parking area for your motorcycle can lead to lower insurance premiums.

- Bundle Policies: Some insurance providers offer discounts when you bundle your motorcycles insurance with other policies, such as auto or homeowner’s insurance.

- Review Coverage Options: Assess your coverage needs and avoid over-insuring your motorcycle, which can lead to higher premiums.

Credit: www.forbes.com